Stable results, higher investments, enhanced reliability of power supply - the Energa Group recaps Q1

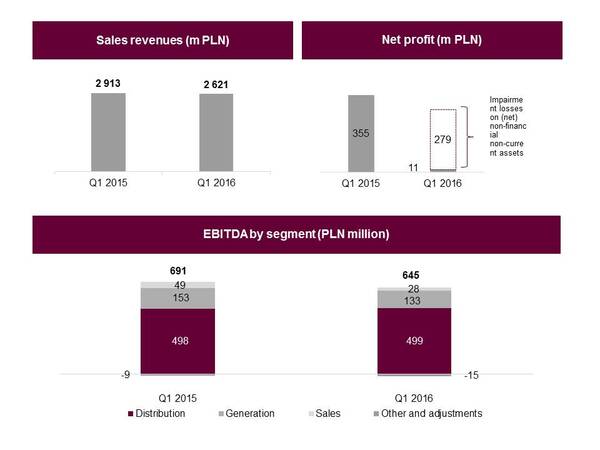

Despite changing market conditions the Energa Group has recorded stable financial performance. In Q1 the Group generated revenues of PLN 2,621 million. EBITDA was PLN 645 million. Gross non-recurring impairment losses of PLN 305 million affected net profit, which was PLN 11 PLN million. Before impairment losses the net result was PLN 290 million.

In Q1 2016 the Energa Group reported revenues of PLN 2,621 million compared to PLN 2,913 million in the corresponding period of the previous year. EBITDA was PLN 645 million, down 7% compared to last year’s result. The net profit of PLN 11 million was affected by the recognition of impairment losses for non-financial non-current assets. The event that diminished, on a non-recurring basis, the operating result by PLN 305 million and net profit by PLN 279 million is purely of an accounting nature and does not affect the Group’s financial position and liquidity.

“Changing market conditions, including ones related to legal regulations pose a challenge to the entire power sector. That is why the Group’s stable position is all the more pleasing to us. This is evidenced not only by its financial performance but also by the 42% growth in investments in this quarter and the enhanced reliability of power supply, confirmed by shrinking the duration of interruptions by more than 70% and their number by more than one half. The 14% upswing in the volume of energy sold and the 3% upswing in distributed energy also deserve attention”, emphasizes Dariusz Kaśków, President of the Energa SA Management Board.

Results in the various operating areas:

Distribution Segment - the Group’s key area sustained its EBITDA result in Q1 at last year’s level of PLN 499 million despite less conducive market and regulatory conditions. The 3% growth in the volume of distributed energy coupled with the simultaneous decline in the average sales rate of distribution services made a positive contribution to the results (effect of the lower tariffs in force in 2016). Revenues on connection fees, down from last year, also had an adverse impact.

Sales Segment – this segment generated an EBITDA result of PLN 28 million compared to PLN 49 million in the same period one year ago. The principal cause of this decline is the lower margin on electricity, which is chiefly the outcome of not incorporating the costs of white certificates in the process of contracting sales (this obligation was not extended to 2016 until the end of December 2015). At the same time, this segment is fastidiously developing its natural gas trading activity. The volume has shot up ten times (from 67 GWh in Q1 2015 to 671 GWh in Q1 of this year, precipitating an increase in the natural gas sales margin by PLN 6 million year on year).

Generation Segment - EBITDA was PLN 133 million compared to PLN 153 million in Q1 2015. Considering that the volume of power generation was down by 0.2 TWh and support in the form of green certificates for the Włocławek Hydropower Plant and in the form of biomass cofiring was reduced, these are sound results. Our response to the unfavorable environment was to cut fuel costs in generation – the expenses for coal and biomass were reduced by PLN 50 million compared to Q1 2015, which was due to declining production volumes, the shift in the fuel mix (elimination of more expensive biomass) and lower unit costs to buy coal.

The impact exerted by the impairment loss of PLN 305 million to non-financial non-current assets on net profit was PLN 279 million.

More business clients, more energy sold

At the end of Q1 2016, the total installed generation capacity in the Energa Group was 1.31 GWe. The Group generated 1.0 TWh of gross electricity compared to 1.2 TWh in the corresponding period of the previous year. This decline was primarily driven by lower coal-fired production in conjunction with the lower demand for operation of the Ostrołęka Power Plant for the Transmission System Operator and the capital overhaul of one of its power generation units. Considering the limited support afforded by the Renewable Energy Sources Act to sources cofiring biomass and the ongoing adaptation of the dedicated installation, in Q1 of this year the Group did not generate power in this source. In addition, on account of weather conditions, the production of wind parks was down.

In Q1 2016 heat generation rose by roughly 7% resulting from greater demand on local markets.

The volume of electricity supplied by Energa-Operator edged up by 3% to 5.6 TWh compared to 5.5 TWh of energy distributed in the corresponding period of last year.

Sales of electricity to final end users was 4.9 TWh, up 14% from Q1 of last year – this is chiefly the effect of higher retail sales thanks to acquiring a number of new offtakers in the strategic and business client and public institution segments. In turn, as an effect of the decline in power sales on the wholesale market, the total volume of power sold in the first 3 months of the year was down 13% from the same period in 2015.

Investments - significant improvement in the reliability of electricity supply

At the end of Q1 2016 the supply continuity ratios proved to be materially better than in the same period of the previous years. The average duration of an interruption per user (SAIDI index) shrunk by nearly 70% (it was 25.5 minutes compared to 88.1 minutes in the corresponding period of last year). The average frequency of interruptions in the supply of electricity per user (SAIFI index) plummeted by more than one half from 0.9 to 0.4. This improvement also stems from the fact that in Q1 of this year there were no mass interruptions like the ones caused in the corresponding period of last year by Hurricane Felix. The consistent investment policy in grid modernization has also made a contribution. The improvement in power supply reliability has also been visible over the last several years: in comparison to the first 3 months of 2013, in the past quarter the average duration of an interruption per user shrank by 14.2 minutes, i.e. by 36%, while the average frequency of an interruption per user has fallen from 0.53 to 0.4.

In Q1 the Group’s total capital expenditures were PLN 381 million, up 42% compared to the first 3 months of the previous year. More than 70% of that amount, i.e. PLN 269 million is made up by capital expenditures in the Distribution Segment. These capital expenditures made it possible to do the following:

- connect 7.4 thousand new customers,

- build and modernize 741 km of medium voltage and low voltage lines,

- connect new renewable energy sources totaling 55 MW to the grid.

The capital overhaul and adaptation of another power generation unit in the Ostrołęka Power Plant to environmental requirements continued in the Generation Segment. Work to commission the Parsówek Wind Park with a capacity of 26 MW is at its final stage – in Q1 it received a concession from the Energy Regulatory Office.