Energa Group recaps the first 3 quarters: growth in distribution and further development of RES

In the first 3 quarters the Energa Group generated revenues of PLN 8.0 billion and earned EBITDA of PLN 1.7 billion. In the Distribution Segment, which is of key significance to the Group EBITDA rose 15%. The Company is launching an Efficiency Enhancement Program expected to bring PLN 250 million of incremental EBITDA by 2018.

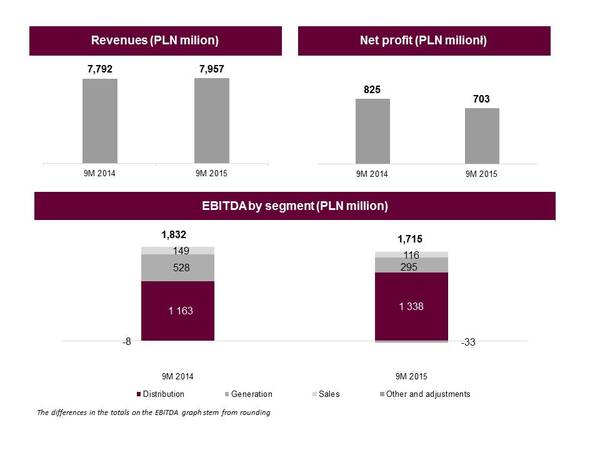

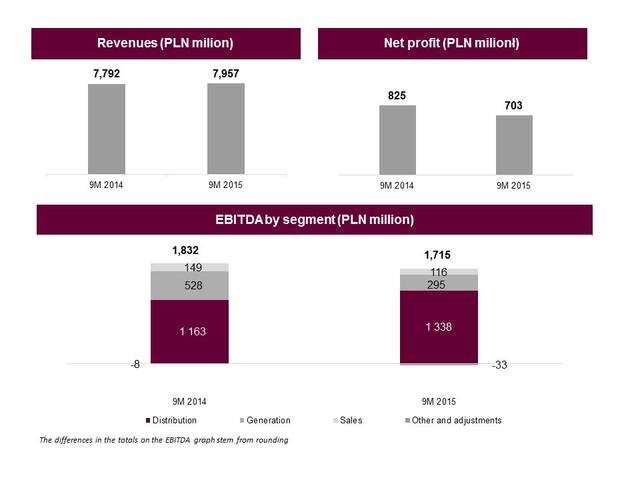

During the first three quarters of 2015, the Energa Group generated revenues of PLN 8.0 billion, signifying 2% growth compared to last year. EBITDA was PLN 1.7 billion, compared to PLN 1.8 billion in the first three quarters of 2014, with net profit at PLN 703 million, down 15% from the corresponding period in 2014.

The following factors exerted the main influence on the results for the first 3 quarters:

- Enhanced results in the Distribution Segment attributable to higher demand for energy, lower network losses and higher connection fee revenues.

- Diminished EBITDA in the Generation Segment caused primarily by extremely challenging hydrological conditions, market factors and lower production due to the overhaul of one of the units in the Ostrołęka Power Plant (Q3) and lower demand for must run production.

“The past three quarters was a period in which we improved the quality of business and developed renewable energy source (RES) projects. Despite the challenging market conditions we improved our performance in distribution, which accounts for the biggest portion of our earnings. In the past few months we finalized a project to roll out a second photovoltaic farm - the largest photovoltaic power plant in Poland. Work to build the Parsówek wind farm is under way and another 2 wind projects are under preparation. By 2020 we want to grow the percentage of RES in our generation capacity significantly”, says Andrzej Tersa, President of the Energa SA Management Board.

Efficiency Enhancement Program as a new source of enhancing the Group’s results

To improve results in upcoming periods, the Company is implementing an Efficiency Enhancement Program expected to bring PLN 250 million of incremental EBITDA in 2018. This program will be attained by pursuing quality, revenue and cost-related initiatives. Energa will endeavor, among other things, to augment sales efficiency and optimize asset management while the actions taken will enable it to define the additional potential to drive revenue expansion.

“We assume that the Efficiency Enhancement Program will exert a positive impact on our financial results as soon as in the first year of its execution with the largest effects being achieved in 2018. We are discontinuing efforts to look for simple savings – we will focus on multifaceted enhancement of operational efficiency in all the Group’s business segments”, says Jolanta Szydłowska, Energa SA’s Vice-President for Corporate Affairs.

Results of the various segments in the first three quarters

The segment of key importance for Energa, the Distribution Segment, recorded improved results – EBITDA rose 15% to PLN 1.3 billion, which accounts for approx. 78% of the Group’s total EBITDA, and the net profit in this area improved 28% reaching PLN 564 million. The improved results are primarily attributable to a higher volume of distributed energy and the fee rates for distribution services. Earnings also improved as network losses trended down, translating into a lower cost to purchase energy to cover them. Connection fee revenues were also materially higher, which ensued chiefly from the higher number of wind farms and the traction substations for Pendolino trains.

The Generation Segment exerted an adverse impact on the Group’s results in the first three quarters of the year. In the first 9 months of the year the Group’s revenues in this area were down 20% to PLN 1.1 billion. EBITDA was PLN 295 million, compared to PLN 528 last year, while net profit was PLN 98 million. The results in generation deteriorated was caused primarily by market factors, extremely challenging hydrological conditions resulting from the summer drought, the overhaul of one of the units in the Ostrołęka Power Plant and lower demand for must run production in this plant.

In the Sales Segment the Group recorded lower profitability – EBITDA was PLN 116 million, compared to PLN 149 million last year. However, revenues remained stable at PLN 4.2 billion. Results deteriorated following the lower margin on electricity (the costs of purchasing electricity grew faster than the average sales prices) and a non-recurring event in 2014 (restructuring provisions were reversed, thereby improving the 2014 result).

Challenging conditions and market factors caused lower energy production

The total installed generation capacity in the Energa Group was 1.4 GWe, with RES accounting for 0.56 GWe. The Group generated 3.2 TWh of gross electricity, compared to 3.8 TWh generated in the same period last year. This decline was primarily driven by lower production in the Ostrołęka Power Plant. This was associated with lower demand for the operation of this power plant for the Transmission System Operator and general overhaul of one of the units in Q3. RES production in the first three quarters of 2015 was down 5%. This resulted mainly from the extremely challenging hydrological conditions in the summer months. As a result of more wind and additional production from the new Myślino wind farm, the production of energy in wind farms shot up 27%. Energy generated in the photovoltaic farm built last year was included in 2015 production.

The volume of electricity transmitted by Energa-Operator was over 16 TWh, which was 3% higher than in the previous year.

The sales of electricity to end-users edged up 2% to 12.3 TWh while the volume of energy sold on the wholesale market fell by 10% to 6.5 TWh.

More investments in connections and environmental compliance

In the first 9 months of 2015, capital expenditures were PLN 997 million, of which PLN 719 million in the Distribution Segment. This was 40% more than in the same period of 2014.

In particular:

- 9 thousand new customers were connected,

- 2,715 km of medium voltage and low voltage lines were built and modernized,

- 492 MW of new sources were connected to the grid.

In the Generation Segment, capital expenditures were PLN 245 million and were related among others to the tasks related to the adaptation of equipment in the Ostrołęka Power Plant B to environmental requirements. Capital expenditures were also associated with RES generation capacity development projects: building the Parsówek wind farm with a capacity of 26 MW and completing the construction of the Czernikowo photovoltaic power plant with a capacity of 4 MW in mid-October.

Energa as the leader in the solar energy sector in Poland

At the end of October Energa launched the largest photovoltaic farm in Poland. The Group’s photovoltaic power plant in Czernikowo has a capacity of 4 MW and is an element of aninnovative project entitled Smart Toruń. This is a pilot program in which the Energa Group is implementing smart power grids, modernizing the distribution grid and generating energy in renewable sources while offering smart street lighting and demand response in conjunction with clients.

The annual production of electricity in Czernikowo is estimated to be 3,500 MWh. It will suffice to cover the demand generated by approx. 1,600 households. This installation consists of nearly 16 thousand panels – each with a capacity of 240 W.

By rolling out another RES project, the Company is following the global trend of developing innovative and environment-friendly technologies. As part of its strategy, Energa intends to grow significantly the percentage of RES in its generation capacity prior to 2020.

Q3 2015 results

The Polish Press Agency’s consensus assumed that the Group would earn revenues of PLN 2.5 billion, EBITDA of PLN 498 million and net profit of PLN 171 million, meaning that the results were in line with analysts’ expectations. Revenues remained steady at last year’s level and totaled PLN 2.5 billion. EBITDA was PLN 499 million, compared to PLN 551 million in Q3 2014. Net profit was PLN 168 million, compared to PLN 218 million in Q3 2014. The Group enhanced performance in the Distribution Segment, in which EBITDA was 9 percent higher compared to last year.