Higher profit of the ENERGA Group

ENERGA Group recorded improved performance in three quarters of 2014. Consolidated EBITDA increased by 24% to PLN 1,832 m, while net profit was PLN 825 m, compared to PLN 581 m in the same period of 2013. The Company's Management Board has updated the Investment Program. Due to a more efficient execution of investment projects, the Group will fulfill its investment objectives with lower expenditures.

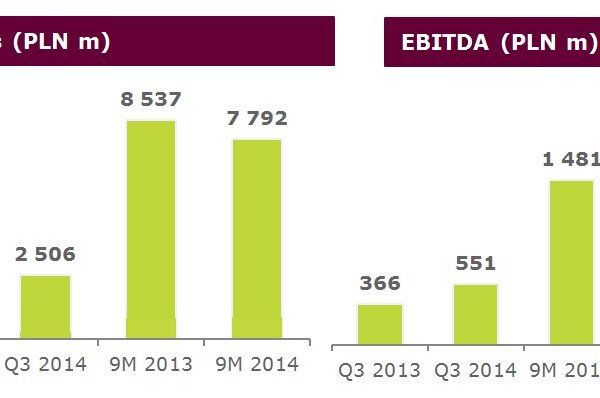

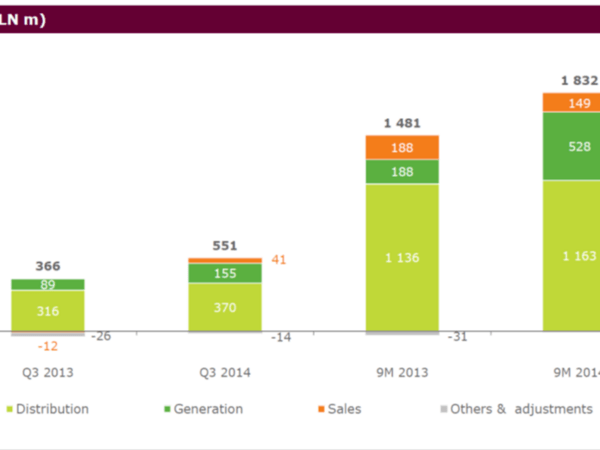

After nine months of the year, the ENERGA Group earned net profit of PLN 825 m, up from last year's PLN 581 m. Consolidated EBITDA increased by 24% year-over-year to reach PLN 1,832 m. This excellent performance was achieved despite a 9% drop in revenues, which were at PLN 7,792 m after three quarters.

In the third quarter of the year, the Group earned the net profit of PLN 218 m compared to PLN 59 m in the same period of the previous year. Consolidated EBITDA increased by 51% year-over-year up to PLN 551 m. The Group has improved its performance in all its operating segments, while the highest gains were recorded in generation and improvement in the Ostrołęka Power Plant business line. In the third quarter the Group posted revenues of PLN 2,506 m.

Compared to three quarters of the previous year, the growth rate was materially affected by: last year's impairment allowance for Unit B at ENERGA Elektrownie Ostrołęka SA, which materially reduce the Generation Segment's financial result in Q1, and costs of employment restructuring incurred in Q3 2013. The financial results of three quarters of this year were additionally boosted by the reversal of the provision for CO2 emission allowances. After 9 months of the year and excluding the impact of one-off events, EBITDA increased by 9% year-over-year.

- The improvement of the Group's performance, that is higher margins and profitability ratios, is a consequence of our improved operating efficiency, a goal that we continue to work on. The better performance was, to some extent, an effect of non-recurring events, but even when they are excluded, we can see stable growth as compared to the previous year - stated Mirosław Bieliński, President of the Management Board of ENERGA SA.

During the three quarters of 2014, the Group supplied 15.5 TWh of electricity to more than 2.9 million customers (up by 2%). The volume of energy sold was 19.3 TWh, 15% less than in the same period of the previous year. The volume of electricity sold to end users has fallen by about 8%, mainly in tariff groups A and B, which was driven by a change in the sales strategy.

In the nine months of 2014, the ENERGA Group generated 3.8 TWh of electricity, which was similar to the previous year's level, of which 1.4 TWh from renewable energy sources.

Good performance in generation and distribution

During the three quarters of 2014, the results of the Generation Segment improved significantly. Compared to the same period of the previous year, revenues increased by 18% to PLN 1,320 m and the segment's EBITDA was PLN 528 m compared to PLN 188 m in the same period of 2013. The system power plant contributed the most to the improved performance. The results were much better even after the effect of last year's impairment allowance of Unit B at Elektrownia Ostrołęka was excluded. Higher selling price of electricity, revenues from the operating reserve and lower fuel consumption costs also contributed to the improved performance in this area.

ENERGA has been developing its renewable energy generation capacity through diversification of its portfolio of power sources. As a result, the seasonality effect, which can usually occur in the case of homogeneous energy sources, has been visibly reduced. Individual renewable sources complement each other, which translates into greater stability of both energy generation and revenues earned on its sales.

In the three quarters of the year, the Distribution Segment posted EBITDA of PLN 1,163 m, or 2% more than in the same period of the previous year. In the third quarter, performance improved by 17%, despite the drop in WACC, which is the basis for calculating the return on equity, which in turn is an important component of remuneration of a distribution company. Both the increase in supplied energy volumes and average rates charged for selling distribution services contributed to a better performance in the period.

Modification of the investment program

The company has updated its Investment Program following a pre-announced annual analysis of current market conditions and a review of assumptions. The current program covers the years from 2014 to 2022. During that period, PLN 11.8 billion is to be spent on basic investment projects, of which PLN 9.8 billion in the distribution segment, where key investment projects include connection of new customers, expansion and modernization of the grid and development of smart grid. Total capital expenditures planned by the Group in the years 2014-2022 will be PLN 18.2 billion and will also cover additional development projects, to be implemented, among others, in the area of RES, acquisitions and research and development projects. The update of the Investment Program resulted from, among others, large savings made so far: following an improvement in efficiency of executing investment projects, the Group is now able to achieve its goals with lower expenditures.

- We are taking a long-term view of our operations; this Investment Program update follows from an ongoing review of our needs. We will maintain the strategic development directions of the ENERGA Group. Thanks to the projects that we've already executed and the increased efficiency, we will be able to achieve our strategic goals with lower expenditures - added Mirosław Bieliński.

Completion of further investment projects

ENERGA completed several generation projects during the three quarters of 2014: in July a new biomass unit was commissioned for production in Elbląg, increasing the Group's RES capacity by 25 MWe. In Gdańsk, ENERGA built a photovoltaic farm with a total capacity of 1.64 MW. The installation will generate about 1.5 GWh annually, which is sufficient to meet the demand of about 720 households. Photovoltaic technologies are getting cheaper faster than any others. In the future, larger-scale investments in electricity generated by solar panels are bound to become a promising business. ENERGA is building its competence in this field. Also, a photovoltaic power plant with an approximate capacity of 4 MWe is built in Czerników. Recently, the ENERGA Group has also put into operation a new heat source for Ostrołęka; thanks to this modern installation, part of the Ostrołęka Power Plant started generating heat in addition to electricity.

ENERGA manages demand for electricity

In September, ENSPIRION, an ENERGA Group company, was the first entity in Poland to generate "negawatt power": it conducted two commercial campaigns aimed at reducing demand for electricity in peak hours. The Company rewarded its business clients for reducing electricity consumption in peak hours upon its request.

Moreover, the "Kalisz test" completed this year has shown that, through the application of advanced metering infrastructure (AMI), demand control is also feasible among individual customers. ENERGA conducted consumer tests in Kalisz for over a year. The tests have shown that, upon request, households are able to reduce power consumption by up to 30%. At the same time, they reduced their total electricity consumption by a few percent.

These campaigns prove that the mechanisms, which reduce and shift demand for electricity can be one of the ways to prevent energy deficit. Without limiting its commercial nature, ENERGA continues to work on other solutions to both reduce demand for energy and to shift demand to off-peak hours.