ENERGA Group posts earnings growth and efficiency gains in Q1 2014

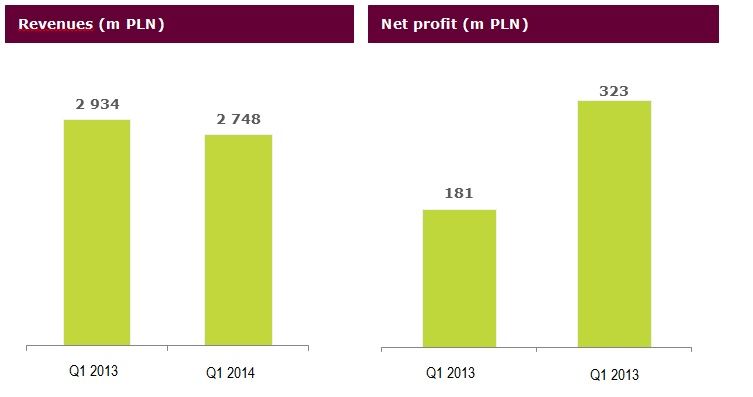

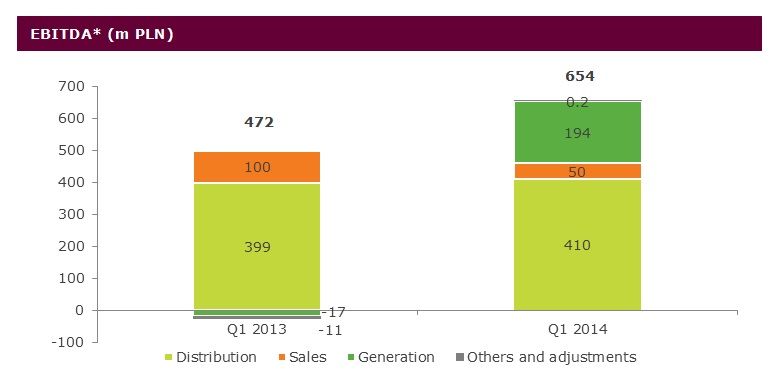

The ENERGA Group grew net profit by 79% and EBITDA by 39% in Q1 2014. In comparison with the same period last year, it achieved these results even though revenues were down by 6%. “The ENERGA Group will continue to focus on further enhancing operational efficiency”, announces its CEO.

In Q1 2014 the ENERGA Group recorded net profit of 323 million PLN, signifying 79% growth. EBITDA at 654 million PLN was up by 39% compared to last year’s result. Revenues were 2 748 million PLN, signifying a decline of 6%. The generation and distribution segments contributed to improving the results.

In comparison to the same period last year, last year’s impairment charge for power unit B in ENERGA Elektrownie Ostrołęka SA, which materially reduced last year’s financial result, contributed to the magnitude of growth in the current profit. Upon removing the impact of this one-off event, net profit grew by 15%, while the Group improved its EBITDA by 10%. The Group has been able to produce stable growth by streamlining operational efficiency. In Q1 2014 the Group commanded higher profit margins, and its profitability ratios on an annual basis are also better.

Standalone net profit, which forms the basis for the dividend payment grew by 24% in Q1 to 725 million PLN. Its stable financial position lends support to the pursuit of its ambitious dividend policy calling for the payment of 92% of the standalone net profit earned in a year. It is the Management Board’s steadfast intention to pursue the company’s policy of distributing profits and thus ENERGA should be perceived as a company paying significant and predictable amounts in the form of a dividend.

“At the Group level, in Q1 2014 we upheld last year’s level of profitability, and since we have a „clean slate” in terms of one-off events, we were able to post considerable growth of earnings and EBITDA. Previous years’ investments, especially last year’s record-breaking investments, positively affect our results – that is why lower total revenues across the Group’s companies did not adversely affect our earnings. Our priority continues to be efficiency – we are consistently expending our efforts where it is possible to make efficiency gains and where we have the opportunity to share them with our clients and shareholders”, says Mirosław Bieliński, CEO of ENERGA SA.

Sales revenues rose in the Generation Segment and the Distribution Segment by 26% and 8%, respectively, while the Sales Segment reported a 19% decline in this period. The higher average rate for the sales of distribution services by ENERGA-OPERATOR, the nearly 6% higher volume of distributed electricity, the revenues generated thanks to the three wind farms acquired in the latter half of 2013 and the sale of the inventory of property rights at prices higher than the prices prevailing on the date of generation positively contributed to the level of consolidated revenues.

The level of consolidated revenues was also affected by the decline in the volume of electricity sold to end users (by approximately 10% compared to the same period last year), which in Q1 2014 was 4.3 TWh. This stems from modifying the Group’s sales strategy whereby it does not renew unprofitable contracts (in tariff groups A and B) and from lower power consumption by retail clients, which was also influenced, among other factors, by weather conditions. In this last period there was also a decline in power sales on the wholesale market (by approximately 10%) to 2.7 TWh.

The obligation to purchase power from renewable energy sources (RES) not belonging to the Group also contributed to the Sales Segment’s worse results. According to the Energy Law, ENERGA-OBRÓT, as a seller of last resort, is obligated to purchase the power generated by the RES located in its area of operation. Power is purchased at what is referred to as the official price, namely the average price of sale for electrical energy on a competitive market from the previous year, which is frequently higher than the current market price.

The data on the graphs have been presented on a consolidated basis:

* Differences in totaling segment results come from rounding

The ENERGA Group’s total installed generation capacity at the end of Q1 2014 was 1.3 GWe and 0.9 GWt. The Group’s gross electricity production was 1.3 TWh, i.e. 3% less than in Q1 2013. This decline was chiefly driven by lower production in ENERGA Elektrownie Ostrołęka SA caused by an outage in one of the power units and worse hydrological conditions, which have an effect on electricity generation in hydro power plants. RES generation rose in turn to 482 GWh from 452 GWh last year.

The volume of electricity distributed in Q1 2014 by ENERGA-OPERATOR to 2.9 million clients was 5.3 TWh, compared to the 5.0 TWh of electricity distributed in the same period last year.

The volume of electricity sold in Q1 2014 to end users was 4.3 TWh compared to 4.7 TWh in the same period of 2013, with the energy sold on the wholesale market falling by 10% on an annual basis to 2.7 TWh.

Bad weather affected the operation of the grid

At the end of Q1 2014, the average interruption duration per client (SAIDI index) was 107.1 minutes compared to 39.7 minutes in the same period last year. The widespread interruptions caused by bad weather contributed materially to the SAIDI index being higher. For this same reason, in Q1 2014 the average interruption frequency in the supply of electricity per client (SAIFI index) rose from 0.53 to 1.01.

To minimize the impact exerted by unforeseen events on grid interruption the ENERGA Group constantly invests in its modernization and expansion to make it more resilient. Modern solutions in this area make it possible to augment efficiency even in the face of bad weather. In Q1 2014 the Distribution Segment’s capital expenditures attracted 154 million PLN of the Group’s total capital expenditures of 195 million PLN. These capital expenditures were earmarked to modernize the grid among others, which also entailed implementing Smart Grid infrastructure.

Final decision on the dividend level to be made soon

In March the ENERGA SA Management Board recommended the payment of 414 067 114 PLN as a dividend from the standalone profit of 2013 (1 PLN per share). The Annual Shareholder Meeting will make the final decision on the dividend level on 20 May 2014. According to the draft resolution on this matter, the date of record is to be 27 May 2014, with the proposed dividend payment date being 10 June 2014.

Inquiries:

Beata Ostrowska

ENERGA Group’s press spokesperson

e-mail: Beata.Ostrowska@energa.pl

Telephone: (+48) 58 34 73 954

Significant blocks of shares / change in the ownership