ENERGA Group improved its financial results again

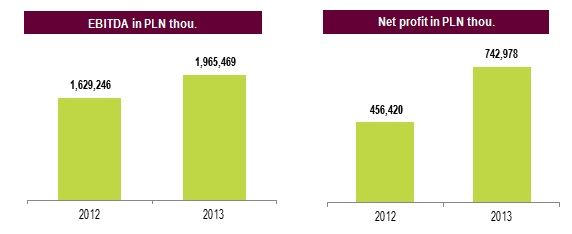

ENERGA Group ended 2013 with very good financial results. Revenues grew by 2 per cent to the level of PLN 11.4 billion. EBITDA amounted to almost PLN 2 billion and was by 21 per cent higher than in 2012. Net profit was by as much as 63 per cent higher and amounted to PLN 743 million. The Supervisory Board of ENERGA SA positively opined the distribution of PLN 414 million dividend recommended by the Management Board of the Company, i.e. PLN 1 per share. This the level higher than that indicated in the issue prospectus.

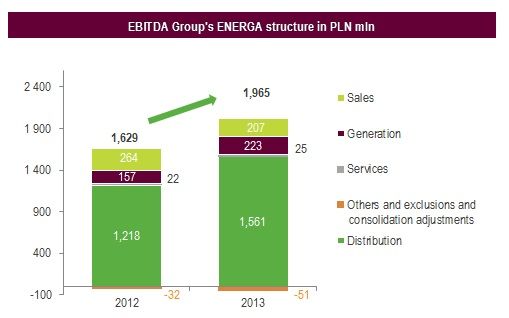

Consolidated sales revenues in 2013 grew by PLN 252 million (2 per cent) to the level of PLN 11,429 million. The level of sales was positively affected by a higher distribution tariff, favourable hydrometeorological conditions for generation in hydroelectric plants and higher generating capacity in energy renewable sources. The Group's generated EBITDA was higher by 21 per cent and amounted to PLN 1,965 million, and net profit grew by 63 per cent and amounted to PLN 743 million. Margins improved: EBITDA profitability grew to 17.2 per cent from 14.6 per cent, and on the level of net profit the margin amounted to 6.5 per cent in relation to 4.1 per cent in 2012. Dynamic growths of EBITDA and net profit were influenced by segments of distribution and generation.

Good financial results enabled the Management Board of ENERGA SA to recommend the distribution of PLN 414 million dividend from the standalone profit for 2013 (PLN 499 million), i.e. PLN 1 per share. The policy of dividend distribution is consistently realised by the company: in 2012 it designated for dividends PLN 646 million, which constituted 86 per cent net profit, and in the next year - PLN 497 million, which is 91 per cent of the profit. The General Meeting of Shareholders will make the final decision on the payment from the profit for 2013.

- We are satisfied with the generated results and in accordance with our declaration, in this and subsequent years, we will want to share a significant part of the profit with the Shareholders. The dividend distribution recommendation in the amount exceeding this anticipated in the prospectus is a proof of fulfilment of this declaration. During the last year investors appreciated the stability of our business, which is evidenced with e.g. the successful issue of Eurobonds or conduct of the largest in the two last years public offering of shares and début on the Warsaw trading floor - says Mirosław Bieliński, President of the Management Board of ENERGA SA.

ENERGA SA debuted on the WSE on 11 December 2013, and being listed on the Stock Exchange was preceded with a public offering of share sales totalling to PLN 2.4 billion. Formerly, ENERGA gained financing in the amount of EUR 500 mln as 7-year Eurobonds, and the scale of interest of investors exceeded the value of offered securities. Additionally, ENERGA SA obtained financing under attractive terms concluding loan agreements in the previous year: with EBRD for PLN 800 million and with EIB for PLN 1 billion.

Higher profitability of distribution - stable business

In 2013 the largest share in the generation of the Group's EBITDA belonged to the segment of distribution, being core within the income structure. The ratio amounted to 79 per cent, i.e. by over 4 p.p. more than in the previous year.

- Our profitability on the level of EBITDA in the segment of distribution grew from 33.1 to 41.1 per cent. Our ambition is to become the leader within the efficiency and we wish to consistently improve our results on all the levels of the income statement. Thanks to that ENERGA Group, being a reliable partner for financial institutions, is able to gain financing on very good conditions - says Roman Szyszko, Executive Vice President of the ENERGA SA Management Board, Chief Financial Officer.

Growth in energy generation - larger revenues

In 2013 the volume of sales of electricity beyond the Group grew by over 12 per cent and amounted to 29.1 TWh. On the wholesale market ENERGA doubled sales which amounted to 10.9 TWh. The Group in 2013 delivered 20.4 TWh of electricity to over 2.9 mln customers.

The total installed generating capacity of ENERGA Group at the end of 2013 amounted to 1.3 GW. The Group generated a gross of 5.0 TWh electricity, which means a growth by 0.9 TWh, i.e. 22 per cent in comparison with the previous year. The largest growth in the production of energy, by 38 per cent, was visible in run-of-river power plants, which was affected by favourable hydrometeorological conditions. Production of units co-burning biomass grew by 27 per cent (2013 was the first full year of operation of the biomass co-burning boiler in ENERGA Elektrownie Ostrołęka).

At the end of 2013 0.5 GW was installed in energy renewable sources (RES) and the production of green energy from the Group's assets amounted to 1.9 GWh of gross electricity.

Efficient investments - benefits for customer

The Group's capital expenditures amounted to PLN 2,802 million (PLN 1,849 million in 2012), of which almost a half, since PLN 1,397 million was designated for investments in the segment of distribution which is core as regards the Group's income. Additionally, ENERGA Group designated PLN 1,052 million for the purchase of wind companies from DONG and Iberdrola Renovables Group and Ciepło Kaliskie company. Finalisation of these transactions increased the generating capacity in RES from 343 MW to 508 MW, contributing to the implementation of the Group's strategy which anticipates strengthening of its position on the market of renewable energy.

Investments realised last year in the modernisation of distribution networks, as in previous years. translate into a better quality of energy deliveries, which is visible in indices specifying both the frequency and duration of power supply interruptions. In 2013 the frequency of interruptions on power supply per consumer (SAIFI index) fell by 12 per cent in relation to 2012. Even though Ksawery hurricane occurred as a result of which the average failure duration per consumer increased by almost 15 per cent (SAIDI index) it still remains by 41 per cent lower than in 2011.

ENERGA Group implements continuous improvement of the quality of consumer service also through investing in the technology development of the distribution business, e.g. construction of the intelligent measurement system which constitutes an element of implementation of intelligent distribution networks. So far, the Group has already installed ca. 400 thou. automatic meter reading units at individual customers and at all business consumers. Innovative solutions already bring specific advantages to customers e.g. as real, not forecast settlements for consumed electricity. Additionally, ENERGA Group successfully tests intelligent distribution solutions, connected e.g. with enhancing power supply reliability.

- Preliminary results of our advanced pilot programmes indicate a high efficiency of the system of intelligent networks in shortening interruption durations on power supply, which has an impact on customer satisfaction and savings for the Company. High efficiency is characteristic also for automatic meter readings, which allows us to enter another stage of offering amenities for customers - on areas covered with AMI implementation we offer specific products based on intelligent measurement - says Wojciech Topolnicki, Executive Vice President of the ENERGA SA Management Board, Strategy and Investments.

Organised Group - more efficient operation

In 2013 ENERGA continued the process of reorganisation and structuring of the Capital Group. The goal of these activities is raising the profitability through cost optimisation and also a greater integration of basic areas of operations. A new corporate governance based on market rules and competition strategies was implemented along with the management by objectives policy. The business model of the Group was based on three, autonomous as regards realisation of business objectives, segments: generation, distribution and sales. ENERGA SA plays a controlling and strategic function in this model.

*The EBITDA presented in this communication is defined and calculated by the Company as operating profit/(loss) (calculated as net profit/(loss) on continuing operations for the financial period/year adjusted for (i) income tax, (ii) share in profits of associates, (iii) financial income and (iv) finance costs) adjusted for depreciation and amortisation (as disclosed in the profit and loss account). EBITDA is not an IFRS measure and should not be treated as an alternative to IFRS measures. Moreover, EBITDA is not uniformly defined. The method of calculating EBITDA used by other companies may differ significantly from that used by the Company. As a consequence, the EBITDA presented herein cannot, as such, be relied upon for the purpose of comparison to other companies.

Enquiries:

ENERGA S.A.

Beata Ostrowska

e-mail: Beata.Ostrowska@energa.pl

tel. 58 34 73 954

Significant blocks of shares / change in the ownership