Good three quarters of ENERGA Group: almost PLN 600 mln net profit, growth in production and sales of energy

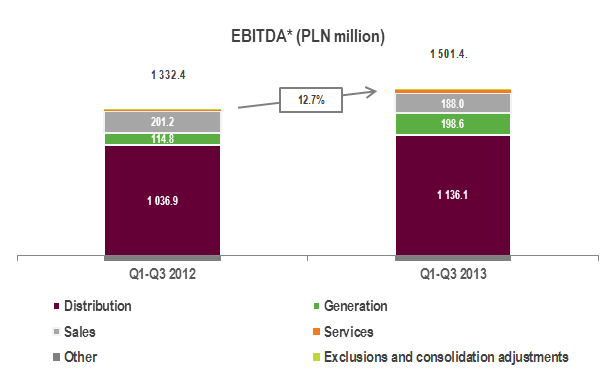

A significant growth in its results reported ENERGA Group during the completed three quarters of 2013. Consolidated sales revenues are higher by 3.6% and amount to PLN 8.5 billion. EBITDA* amounts to PLN 1.5 billion, which means a growth by 12.7%, and the net profit after a growth by 12.7% PLN 598 million.

Sales revenues of ENERGA Group after nine months of 2013 amounted to PLN 8.5 billion and were by PLN 296 million (3.6%) higher than in the same period of the previous year.

After three quarters ENERGA Group increased also the generated EBITDA* achieving its value on the level of PLN 1,501 million (with a margin reaching 18%). It means a 12.7% growth in comparison with the same period of the previous year. And the net profit of ENRGA Group after nine months of 2013 amounted to PLN 598 million and was higher by 12.7% than the net profit generated in the first three quarters of 2012.

-We are particularly happy with the fact that the result growth dynamics is higher than the sales growth dynamics, which means an increase in our business efficiency. After three quarters we generated EBITDA* almost on the same level as we achieved in the whole 2012. Better results are significantly affected by the Distribution Segment which is key for the Group. The results in the generation segment also greatly improved” – says Mirosław Bieliński, President of the Board of ENERGA SA.

ENERGA Group reported an almost 10% growth in the volumes of sales of electricity beyond the Group. After three quarters it amounted to 22.7 TWh. During that time ENERGA Group supplied 15.1 TWh electricity to over 2.9 million clients. The volume of electricity sold on the wholesale market increased by 62% to the level of 9.1 TWh.

ENERGA Group during the three quarters generated a gross of 3.8 TWh electricity, which is by ca. 481.8 GWh (ca. 15%) more than a year before. The greatest growth in the generation by ca. 37% annually was noted by hydropower plants thanks to favorableweather conditions. The Włocławek hydropower plant was up to 48%.

At the end of September 2013 in the Group there was more than 0.5 GWe generating capacities from renewable energy sources (“RES”) of which the Group after three quarters of 2013 generated 1.4 TWh gross electricity.

Over PLN 2 billion capital expenditures

Capital investments also proved to be high. ENERGA Group during the first three quarters designated PLN 2.1 billion on investments comparing to PLN 1.2 billion in the corresponding period year before. It means that they were higher by 75%.

In the Distribution Segment the outlays amounted to PLN 842 million. High expenses within this area are compliant with the investment programme realised by ENERGA Group pursuant to which till 2021 the outlays in the Distribution Segment are to amount to PLN 12.5 billion of PLN 19.7 billion planned for ENERGA Group’s potential investments.

We can see that implementation of the latest technical solutions in the Distribution Segment brings us a regular enhancement of uninterruptible and reliable power supplies, and thus of energy security. We wish to be a leader on the Polish market within this scope and we are pursuing this goal consequently" - adds Mirosław Bieliński.

During the last three quarters of 2013 ENERGA designated also PLN 1,052 million for the purchase of assets of Ciepło Kaliskie and wind company assets from DONG Group and IBERDROLA Renovables. Investments within the development of generating capacities from RES constitute the Group's strategy elements whose one of the pillars is minimisation of ENERGA Group’s impact on the natural environment.

*ENERGA SA defines and calculates its EBITDA as profit/(loss) on operating activity (calculated as net profit/(loss) on the continued activity for the financial period/year adjusted with (i) income tax (ii) share in the profit of the affiliate, (iii) financial income, and (iv) financial expenses) adjusted with amortisation and depreciation (demonstrated in the profit and loss account). EBITDA is not defined by IFRSs and should not be treated as an alternative for measures and categories compliant with IFRSs. Moreover, EBITDA has no uniform definition. The method of calculating EBITDA by other companies may significantly differ from the method used by ENERGA SA for its calculation. As a result, EBITDA presented at this point, as such, does not constitute any basis for comparison with EBITDA demonstrated by other companies.

Additional information:

Beata Ostrowska

ENERGA SA

e-mail: Beata.Ostrowska@energa.pl

tel. 58 34 73 954

Disclaimer:

This message may contain statements relating to the future. Statements relating to the future are based on various assumptions relating the present and future operations of the Company and the environment in which the Company operates presently and will operate in the future. These assumptions include, in particular, the ability of the Company to realise its strategy, and also expectations relating to the profitability and growth, development of the situation in the power sector, capital outlays, availability of financing and restructuring and reorganisation activities planned by the Company. Statements relating to the future are based on the current assessment of the Board and, obviously, on the circumstances which will occur in the future and which as their nature depend on numerous known and unknown questions charged with various risks laying beyond the Company's control. It means that some significant risks may cause that events described in statements relating to the future will significantly differ from the actual state of affairs and may therefore cause that actual results of the Company or its financial position or perspectives may considerably diverge from those expressed or resulting from statements relating to the future, and also from historical results and achievements of the Company.