ENERGA Group 2013–2020 Growth Strategy

Since the ENERGA Capital Group (‘Group’) is facing many new challenges coming from dynamic changes in the environment, the Management Board of ENERGA SA has decided to update the Group Strategy along with the Long-term Strategic Investments Plan (‘Investment Programme’).

The updated strategy paper entitled ‘ENERGA Group 2013-2020 Growth Strategy’ has been approved by both the Management and Supervisory Boards. Following internal and external analyses, a mix of important factors has been identified and taken into account in the process of formulating the modified Group Strategy. Those were mainly the trends observed in the power industry as well as legal conditions (Energy and Climate Package, amended Energy Law and Poland Power Policy until 2030).

The Strategy is also based on a redefined Group mission, which presently reads: ‘we are improving life and work comfort of our customers’. Intention to create a compact, effective and innovative group lies as the foundation of the ENERGA Group Strategy. Due to cooperation and mutual support of its entities, the Group will maintain the leadership position amongst Polish public utilities, raising the efficiency and quality of services rendered.

Value creation of the ENERGA Capital Group will take place through strategic objectives execution in three areas:

- In customer relations we will primarily focus on:

- offering products and services through optimal usage of the Group energy production assets,

- efficient service,

- undertaking of joint ventures (with our customers) in the area of effective power generation and energy utilization.

- Striving for the reduction of environmental impact, our attention will be directed at:

- applying production and distribution technologies materially lowering greenhouse gases emission,

- selecting effective technologies, which utilize natural domestic resources of power generation,

- implementing of innovations to boost energy efficiency as well as to improve power & heat production and distribution processes.

- Growing distribution business willmainly deal in:

- modernization and expansion of distribution network (with increasing potential of renewable energy sources connection),

- a stable growth in operational efficiency,

- reinforcement of power continuity,

- upgrade of service standards to meet customers’ and regulators’ expectations.

The ENERGA Group Investment Program for the years 2013–2021 envisages that total outlays will reach ca. PLN 21 billion, of which:

- around PLN 12.5 billion will be spent for distribution segment investments, and

- the remaining part for: conventional and CCGT power plants, CHP, RES and other investments.

Due to the Investment Program execution, the ENERGA Group will enhance its position as a leader of renewable energy sources usage and will be characterised by low carbon dioxide emission, moderate debt level and limited risk related to new power creation. This will allow the Group to flexibly react to dynamically changing environment of the Polish energy industry in the years to come.

The Strategy implementation should contribute to achieving the following financial and operational objectives of the ENERGA Group by 2020:

- above 10% average annual growth of consolidated EBITDA, whereas 80% of EBITDA will be generated from the existing activity and 20% from new projects;

- maintaining a safe and conservative level of financial ratios, with Net Debt/EBITDA not exceeding 2.5;

- capping outlays for a single project up to the value of the Group’s annual EBITDA;

- sustaining investment level ratings;

- consistent reduction of the SAIDI index (i.e. average duration of a long or very long system interruptions expressed in minutes per one recipient within a year), in accordance with original strategic assumptions, to the level of 190 minutes per recipient annually and the SAIFI index (i.e. average frequency of long and very long system interruptions) by approximately 65% to 1.9 interruptions per recipient annually;

- increase of installed power;

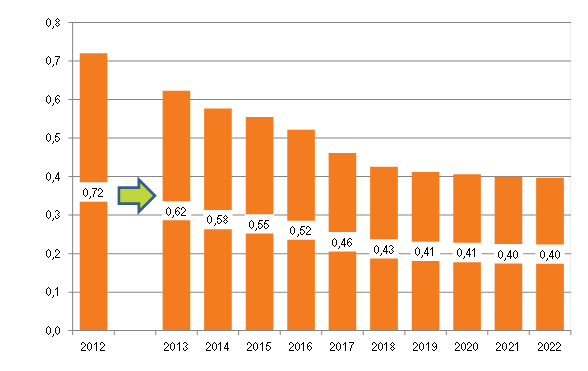

- CO2 emission decline from 0.72 Mg/MWh in 2012 to below 0.40 Mg/MWh in 2022;

- raising RES connectivity to the value of 6 GW (from the current level of 1.6 GW);

- further decrease of a total distribution losses ratio.

Chart: Projection of a CO2 emission ratio from generation sources belonging to the ENERGA Group

by 2022 (in Mg/MWh)

Definition of applied abbreviations:

CHP –heat and power

CCGT – combined cycle gas turbine

RES – renewable energy sources