Energa Group recaps H1: stable results accompanied by more investment

Predictable financial results, higher capital expenditures, enhanced quality of supply, more energy sold and distributed to end users. The Energa Group recaps business results in H1. In this period, it generated revenues of nearly PLN 5 billion with EBITDA topping PLN 1 billion. The company’s management board is engaged in updating its directions for growth. One of them calls for returning to the construction of a power unit in Ostrołęka.

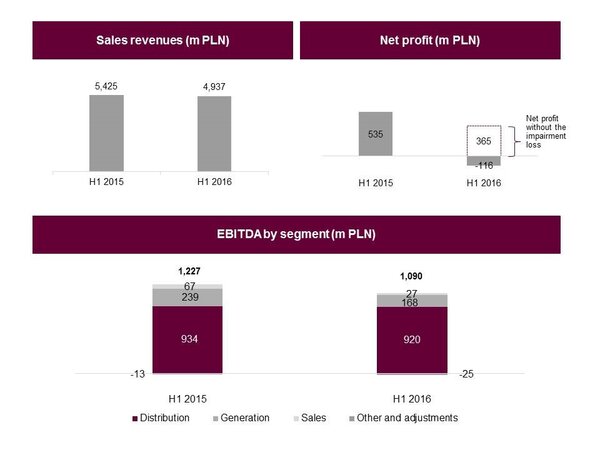

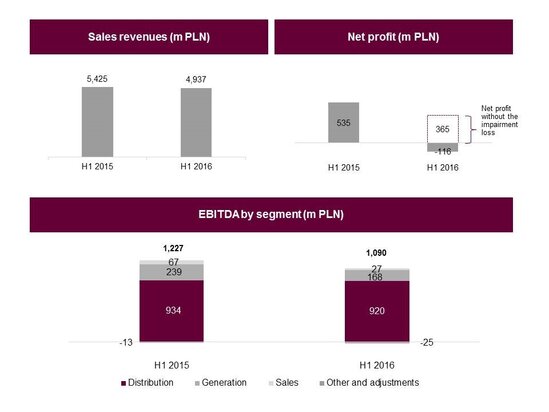

In H1 2016 the Energa Group generated revenues of PLN 4,937 million versus PLN 5,425 million in the corresponding period of last year. EBITDA was down by 11% to PLN 1,090 million compared to last year’s result. On account of non-recurring gross impairment losses totaling PLN 552 million, the Group recorded a net loss of PLN 116 million. Impairment losses on non-financial non-current assets were taken in Q1 and Q2 for PLN 305 million and PLN 247 million, respectively. They are merely non-cash in nature and do not affect the Group’s financial standing and liquidity. Net of these impairment losses, the net result for H1 2016 was PLN 365 million. In addition, Q2 2016 results were affected by the PLN 41 million loss generated by the affiliate called Polska Grupa Górnicza Sp. z o.o.

„The Energa Group has reported stable and predictable financial results despite changing legal regulatory and market conditions. We are steadfastly pursuing our plans – in H1 capital expenditures surged up by 27% above the same period last year; in the Distribution Segment alone, they rose by 29%. These results are visible in the clear improvement in the reliability of supply indices”, emphasizes Dariusz Kaśków, CEO of Energa SA.

At present, the Energa Group is updating its directions for growth. The strategic assumptions imparted by the management board concentrate on providing for stability and security of energy supply from generation to distribution to clients. That is the reason underlying the decision to re-launch the project to build a 1000 MW power unit in Ostrołęka. At present, work is underway to be ready for tendering, followed by selection of the general contractor for this modern coal-fired power plant. In parallel, the Group is also taking actions to secure a strategic investor or co-investor whose involvement is necessary on account of the magnitude of this investment project and the project’s recommended financing structure.

„The key task facing the energy sector is to ensure energy security in terms of quality of supply and sources of energy. Existing power plants will soon cease to fulfil their role. According to the transmission system operator’s proprietary analyses, Poland will have to decommission economically-depleted power units with a capacity of nearly 6 GW by 2020, while in the period from 2021 to 2035 it will have to decommission more than one-half of the currently installed capacity, which may pose a blackout threat. To avoid this risk, decisions must be made now to embark on new investment projects. The Ostrołęka C project is aligned to the government’s plans for national energy security that for many years to come will be predicated on coal. The decision to resume this investment opens the path for us to do preparatory work and embark on the procedural path to commence the construction of a new generation coal-fired power plant. We see improving market conditions for modern conventional generation. With great hope we are waiting for the capacity market law that must serve as genuine underpinning for the profitability of our investment. We are actively participating in consultations pertaining to this bill”, says Mr. Kaśków, CEO.

H1 segmental results:

Distribution Segment – the Group’s key sector sustained its EBITDA result in H1 at a level close to last year’s despite less favorable market and regulatory conditions – it was PLN 920 million. The segment’s results were affected by the less favorable tariff in force in 2016 and the temporarily faster pace of operating expenditures. The growth in the volume of distributed energy and a non-recurring event in the form of a dispute being adjudicated in favor of the segment made a positive contribution to its results.

Generation Segment – generated EBITDA of PLN 168 million in H1 2016 versus PLN 239 million in the corresponding period of last year. The declining revenues related to the lower volume of generated energy contributed to the deterioration in the results to the greatest extent: scheduled renovation work took place in the Ostrołęka Power Plant; the TSO’s lower demand for must-run generation was also visible. In addition, since weather conditions were less conducive than last year, energy production from wind and hydro was down and the revenues on the sales of green property rights were also lower. The considerable decline in fuel consumption costs driven by the change in the fuel mix and the lower unit cost of fuel purchases made by the segment exerted a positive impact.

Sales Segment – in H1 2016 EBITDA was PLN 27 million versus PLN 67 million in the same period of last year. This segment recorded significant decline, mostly in Q2 on the coattails of the unfavorable circumstances transpiring in June. Driven by weather conditions, energy purchase prices on the spot and balancing markets were significantly higher than their historical levels during this time of the year. This was caused by the much higher demand for electricity on one hand and the the decline in generation from less stable wind sources on the other hand. Gas trading activity is growing rapidly in terms of margin and volume. In Q2 2016 alone this segment generated a margin on the sales of gas that was up PLN 5 million. In July of this year Energa-Obrót SA launched gas sales among retail clients.

More business clients – more energy sold to end users

Energy generation: the Energa Group’s total installed generation capacity at the end of H1 2016 was roughly 1.3 GW. The Group generated 1.8 TWh of electricity on a gross basis versus 2.3 TWh in the corresponding period of last year. Lower generation is the outcome of the renovation work scheduled for Q2 in the Ostrołęka Power Plant and the TSO’s lower demand for must-run generation. In addition, on account of support being limited by the RSE Law for sources that co-fire biomass and the ongoing efforts to adjust the dedicated installation, the Ostrołęka Power Plant did not generate energy from this source in H1 of this year. Production by wind parks and hydropower plants was down on account of weather conditions.

Energy distribution: the volume of energy distributed by Energa-Operator rose by 3% in H1 2016 to 11.0 TWh versus 10.7 TWh of energy distributed in the corresponding period of last year.

Energy sales: to end users totaled 9.5 TWh, up 14% from H1 of last year. The growth in the volume of retail sales stems from attracting new business users with a relatively high level of electricity consumption. In turn, as a result of declining energy sales on the wholesale market, the total volume of energy sold in H1 was down 12% from the corresponding period in 2015. This is the offshoot of lower energy generation from renewable energy sources in the catchment area of Energa-Operator SA. Energa-Obrót, as the „Offtaker of Last Resort” is obligated to purchase energy from renewable sources located in its catchment area. Since generation was lower, the sales of excess volume on the wholesale market were also diminished.

More investment – enhancing the reliability of energy supply

At the end of H1 2016 the reliability of energy supply indices exhibited significant improvement compared to the same period last year. The average interruption duration index per user (SAIDI) shrank by 24%. The average interruption frequency index per user (SAIFI) fell from 1.6 to 1.3. This improvement was also driven by the fact that in H1 there were virtually no unpredictable interruptions at a mass scale (they transpired only in June and were linked to unfavorable weather patterns and investments in progress). Improvement in reliability of energy supply has also been visible in recent years: compared to H1 2014, the average interruption duration per user has shrunk by 35%, while the average interruption frequency per user has fallen from 1.7 to 1.3.

In H1 2016 the Energa Group spent PLN 786 million on investments, signifying 27% growth compared to last year. Nearly 74% of that amount, i.e. PLN 581 million was for capital expenditures in the Distribution Segment. As a result of these investment in H1 of this year:

- 16.9 thousand new clients were connected,

- 1,834 km of high, medium and low voltage power lines were built and modernized,

- 91 MW of new RES sources were connected to the grid.

Tasks related to adapting Power Plant B in Ostrołęka to environmental requirements and the general overhaul of one of the power units accounted for a significant percentage of investments in the Generation Segment. At the same time, the settlement of the construction of the 26 MW Parsówek Wind Park is underway.